Trust Accounting and Reporting Principles, Process, Tools

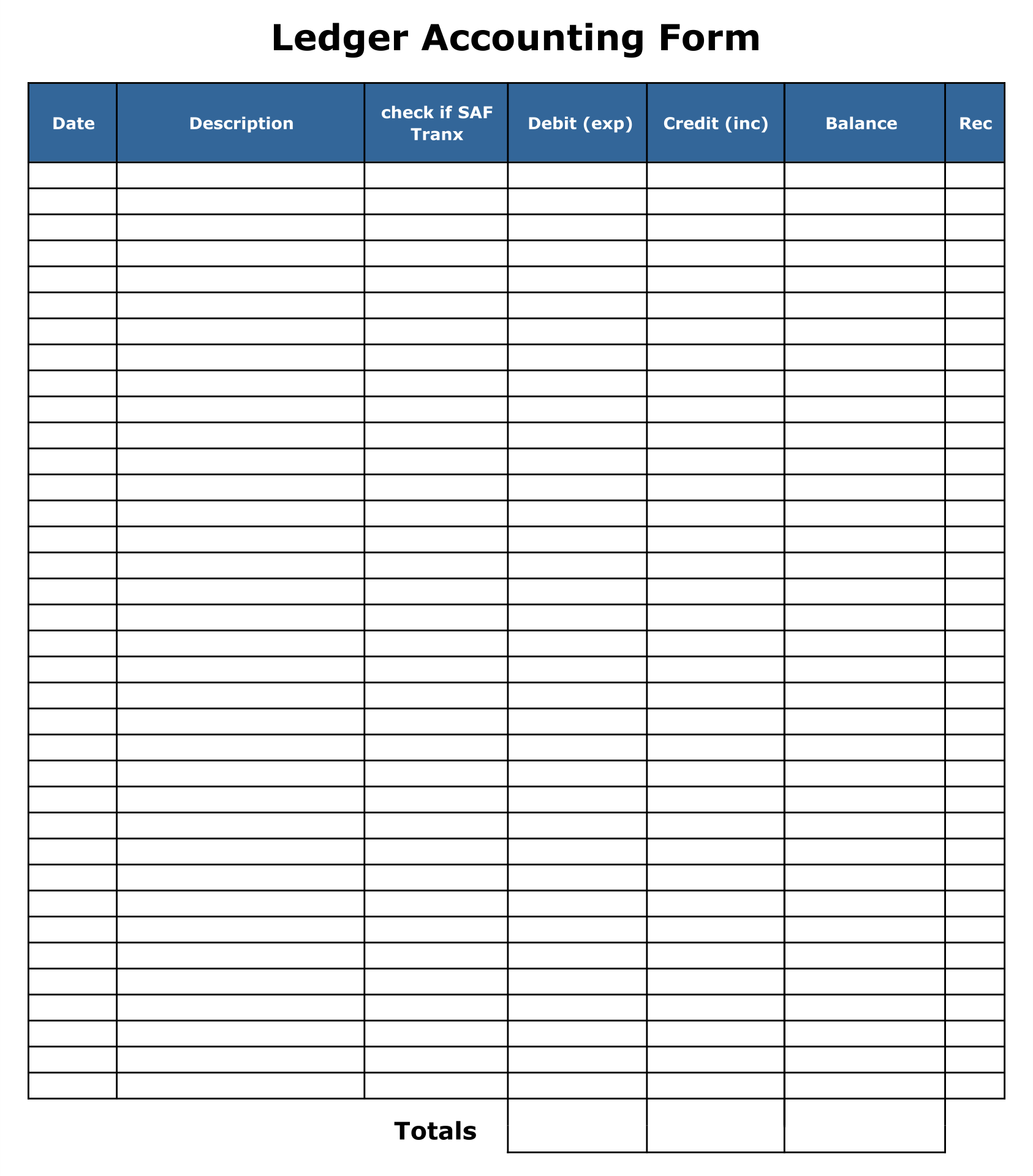

When going to close out those cases, I need to submit a fiduciary accounting to the court for approval. It has to show every receipt and expense, and it needs to distinguish between principal and income. I currently use Lackner 6 in 1 for this, but the software is very clunky, largely because it does a lot more than just produce accounting. There is also OneSource by Thomson Reuters, though it is very expensive (several thousands of dollars per year, depending on how many cases you have). The steps shared by my peer @Jen_D above are the correct process to achieve your goal of setting up the trust account inf and recording the transactions.

Ask Any Financial Question

Get ready to unlock the power of QuickBooks and revolutionize your firm’s trust accounting practices. Next, you will need to add your trust liability account in QuickBooks Online. For the trust liability account, the account type is Other Current Liabilities, and the account detail type is Trust Accounts – Liabilities. If the detail fiduciary accounting software quickbooks type is not set up as Trust Accounts – Liabilities, you will not see the account in the Clio sync screen. Generally, you can select a specific account type as you manually create an account in QuickBooks Desktop. You can use Other Asset, Other Current Liability and whatnot for your estate or trust Chart of Accounts accounting setup.

Fact Checked

The principles of trust accounting include fiduciary responsibility, accurate record-keeping, segregation of trust funds, and compliance with legal and regulatory requirements. These are two completely separate areas of your business and the transactions need to be recorded as such. When researching trust accounting systems, ensure user roles can be customized with specific access rights. For example, an administrator may have full system access while a paralegal only has access to reconcile accounts. Leading solutions like Zola Suite offer role-based permissions to limit access by user and function.

Trust Reporting Tools and Software

Either way, this schedule should show the value of every asset on hand, including the assets detailed in the beginning, and any assets acquired over the course of the accounting period. Trustees and trust account managers must avoid conflicts of interest that could compromise their fiduciary duties. This involves disclosing any potential conflicts, abstaining from self-dealing, and acting in the best interests of the trust beneficiaries at all times. Using trust reporting software can provide numerous benefits, such as improved accuracy, efficiency, and compliance.

- If you’re ready to learn more about adding LeanLaw and QuickBooks Online to your firm’s tech stack, check out our free demo today.

- Quickbooks is accounting software that enables lawyers to automate accounting tasks, manage billing, and project business costs.

- I would still recommend reaching out to an accountant well-versed in the Desktop version.

- LeanLaw is a legal-specific accounting software designed to address the unique needs of law firms, including trust accounting, matter-based accounting, client fund management, and compliant trust account management.

- I set up the trust principal and income accounts under Other Assets and Other Liabilities, and was able to get it to work.

They minimize human error, provide transparency around fund management, and ensure ethical and lawful handling of client monies. Leading solutions offer bank-level security, automated alerts, and role-based access. LeanLaw is designed to generate trust account reports that comply with legal and ethical obligations. While QuickBooks Online provides general accounting functionalities, it may not have the specialized trust accounting features required by law firms. This is where LeanLaw comes in, providing robust trust accounting capabilities that will ensure accuracy at all times and with every trust liability account your firm is responsible for.

7 Top Tax Deductions for Lawyers and Law Firms

Paired with legal practice management software like Clio Manage, streamlining your law firm’s accounting processes and keeping all your information up to date becomes easy. As you evaluate trust accounting systems, consider how well each platform integrates with your existing tools and workflows. The right solution should reduce manual processes while adding visibility across all trust funds and cases. We hope this overview of some of the top trust accounting software for lawyers gives you a helpful starting point in your selection process. Reach out if you have any other questions; we’re happy to offer guidance to help you find the ideal trust accounting software for your firm.

In the digital era, however, technology solutions have emerged that help to streamline the process, reduce manual work, and minimize the risk of human error. When you’re presenting a schedule of assets on hand, you should only include the assets that are your responsibility as a fiduciary. For example, if you are acting as a trustee then you are only responsible for the assets held in the trust; these typically wouldn’t include assets such as joint tenancy property or annuity payments. A conservator, on the other hand, would have to include a joint tenancy account when presenting a schedule, but not a trust asset. Trustees should schedule periodic reviews of account records, reconciliation processes, and reporting procedures to identify and address any issues or discrepancies.

Most accountants view QuickBooks Online as a safe bet for their small business clients. While good legal professionals must possess an in-depth understanding of the law, accounting principles and practices are very likely not their area of expertise. For example, if the trust includes both residential and commercial property, you might have to consult experts in both of these fields to properly manage the assets. Compliance with legal and regulatory requirements is critical to safeguarding trust assets, protecting beneficiary interests, and maintaining professional integrity. Opening a trust account involves selecting a financial institution, providing necessary documentation, and establishing appropriate account controls.

While QuickBooks lacks some specialized capabilities for IOLTA tracking, it can serve as an efficient California trust accounting software solution for smaller firms. The vast QuickBooks ecosystem also allows integration with other legal tools down the line, making it a scalable fiduciary accounting QuickBooks platform. The ability to track interest earned on pooled trust accounts and remit it to state IOLTA programs is a mandatory requirement for legal trust accounting software. IOLTA (Interest on Lawyers’ Trust Accounts) programs collect and distribute interest income to provide legal aid to the poor. Most states require interest earned on lawyer trust accounts holding client funds to be submitted to the state IOLTA program. Trust accounting systems streamline what can be an administratively burdensome task for law practices.

With Clio Manage handling your cases and Clio Accounting managing your financials, you can streamline operations and minimize manual entry errors–enhancing your firm’s performance from intake to payment. We use this account detail type because when you pay a client’s expense on their behalf and expect reimbursement at a future point in time, you are loaning the client money. For example, your law firm pays a filing fee in August and puts the expense on the client’s September bill/invoice. As a result, it is not an expense to your firm, and instead a loan to your client. The section below goes over the following steps you need to take to set up a trust account in QuickBooks Online and Clio.