seven. Follow up having loan providers and system directors

When you find yourself a primary-go out family buyer with reduced so you’re able to average income, you are eligible for help out-of charity or nonprofit groups. These organizations aren’t political however, bring rewarding educational and you will economic information so you’re able to browse very first-time home consumer financing conditions when purchasing the first family.

Another type of nonprofit available over parents plus loan the You.S. ‘s the People Guidelines Corporation away from The usa (NACA). Catering so you’re able to family members which have monetary instability, NACA brings mortgage information and you can training. It interact having loan providers who happen to be ready to complement low-income family from inside the protecting its first mortgage.

What kits NACA apart is that their loan sort of does not demand a down-payment, closing expenditures, or even a base credit score, providing prospective homeowners a tailored approach to meeting basic-time domestic customer financing requirements.

Habitat to have Humanity

Habitat having Humanity is actually an internationally accepted nonprofit focused on providing enough, simple, and value-effective residential property to possess family that have limited income. It engage volunteers to build land, making certain the entire cost stays below other markets solutions post-closure. Very, for folks who satisfy its conditions and you may first-big date household buyer financing standards, this is an opportunity to look at for more reasonable property.

Like other specialized initiatives, a lot of charitable agencies and you will nonprofits are surrounding. The newest U.S. Service of Housing and you will Urban Development (HUD) retains a continuing selection of approved nonprofit organizations in all the county and you will condition. To explore regional casing software that’ll make it easier to refinance or pick a home inside 5 years, you can check out HUD’s site.

Given that a primary-time house client, picking out bucks for the down payment and you may settlement costs is among the greatest obstacles.

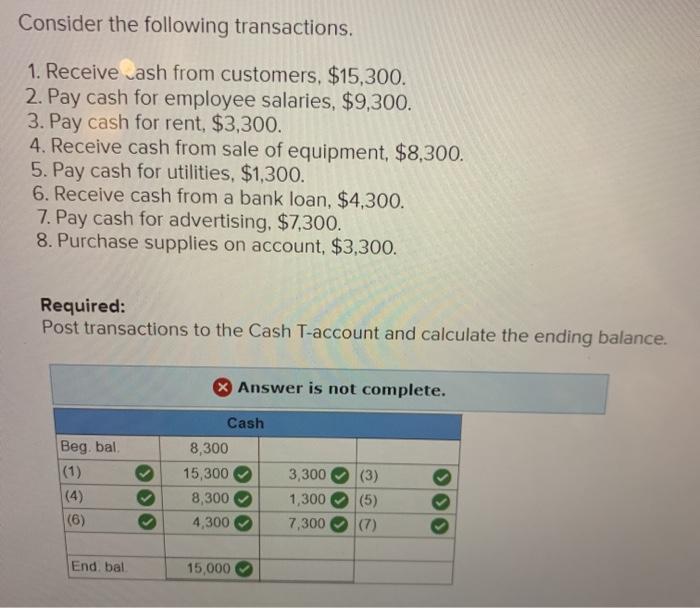

Once you meet up with the basic-time household customer financing criteria into the system you are interested in, it’s time to begin the borrowed funds process. Making an application for a home loan would be an easy techniques when the guess what procedures to take. Here’s a step-by-action self-help guide to help you navigate the applying process and you may raise your odds of providing approved.

Before you start the application form procedure, always meet the very first-go out house visitors financing standards to the system you’re interested in. This usually comes to examining your credit rating, money, a career background, and you can confirming which you meet the definition of a primary-big date domestic customer.

2. Lookup available applications

Discuss various first-big date house buyer programs offered at the fresh federal, county, and you will regional profile. Envision different types of finance and you can guidelines software, instance FHA, Va, USDA fund, or any other authorities-supported and you may nonprofit programs.

step 3. Assemble required papers

- Proof of money (spend stubs, W-2s, taxation statements)

- A position confirmation

- Credit reports

- Bank statements

- Identity data files (age.grams., driver’s license, Social Defense card)

- Records of every other property or obligations

4. Rating pre-approved getting a home loan

Before applying getting specific programs, its good for rating pre-accepted getting a home loan. This involves dealing with a loan provider to choose how much cash you normally use and what forms of fund you be eligible for. Pre-approval offers a far greater knowledge of your finances and you can improves your position when creating an offer into a home.

5plete the application models

Submit the application form models into software you happen to be deciding on. Guarantee every info is appropriate and you can done. This can get involve multiple apps if you find yourself trying to get one another loan programs and extra advice apps.

six. Complete the application

Fill out your finished applications along with the required files so you’re able to the newest respective program administrators. This might be over on line, by send, or in person, according to program’s procedures.

Immediately following submitting your own programs, follow up on loan providers and you can system administrators to verify acknowledgment and check the condition of app. Be ready to bring extra private funds information or files if questioned.