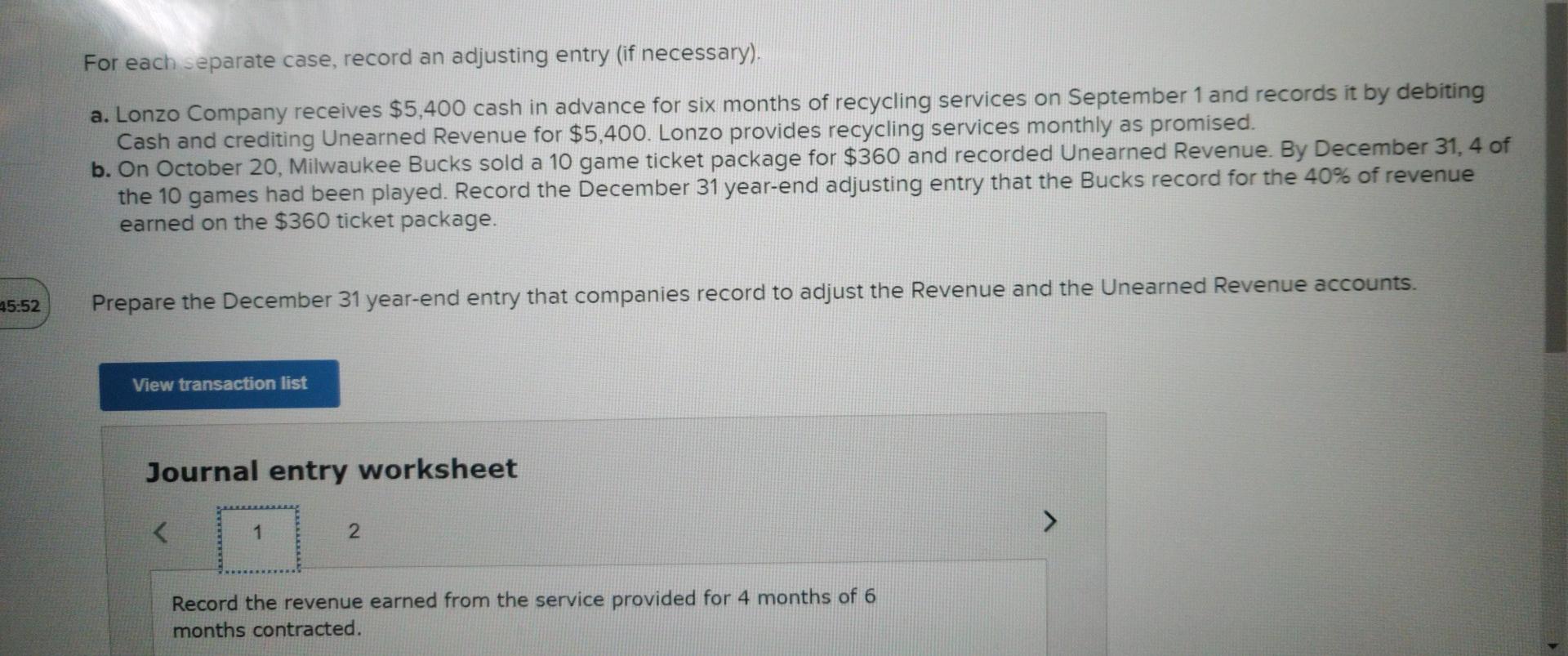

See if a personal loan has an effect on your own financial software

Personal loans are fantastic something, opening the doorway in order to instructions wherein saving is hard, or perhaps digging you of an economic gap with a beneficial steady regular outgoing. From debt consolidation reduction to help you an innovative new automobile, unsecured personal loans are part of of several family monthly outgoings, but there’s that matter we’re often expected at Financial Hut:

Personal loans and you may home loan programs build bad bedfellows, given that each is a stretch on the monthly outgoings. Yet not, all is not missing, and simply that have a consumer loan doesn’t mean you may not getting approved to possess a mortgage.

Signature loans and exposure evaluation

A profitable mortgage software is everything about to present yourself to the latest lender given that the lowest chance. How come having a personal loan affect one to risk testing?

Large quantities of personal debt

That have a higher level out-of debt away from your home loan is actually a significant exposure. It indicates that the strain on your income is great, and you’ve got other regular financial obligation that can take away out of the dedication to your financial (even in the event, for some, the loan is the first financial obligation payment every month).

Lenders will look at your loans so you can income ratio as an ingredient of its value evaluating. This can be derived from the adopting the:

The lower their DTI (loans so you can income), new quicker risk you portray. A personal loan can get a significant effect on your DTI computation. Imagine that with a disgusting monthly income from ?dos,3 hundred, all additional ?115 paid out monthly with debt brings up their DTI percentage because of the four issues.

Most personal loans in the uk is actually anywhere between ?5,000 and you will ?10,000 and portray month-to-month costs off ?180 so you’re able to ?250 a month. For many of us, it means its personal loan introduces the DTI of the at the very least 7% – a serious figure.

Terrible money administration

Mortgage brokers may prefer to know the reason for your very own financing. If it is to have an activity for example a vacation, then it can be considered a poor decision so you can prioritise instance a costly journey before trying safer a home loan. While a consumer loan as an element of a personal debt refinancing bundle do rule there might have been bad currency management on the history.

Of the many aspects of unsecured loans, car purchases and home improvements are definitely the the very least attending provide reason behind matter.

Frustration

The new poor factor in a personal bank loan is when you may have removed one out of monetary frustration. This may mark you due to the fact a life threatening exposure getting home financing bank and can even place your software at risk. When you are a simple unsecured loan together with your financial try impractical in order to code desperation, payday loans try a robust indicator which you have come troubled towards twenty four hours-to-date base.

For this reason, many lenders will refute software away from people who’ve a good recent pay day loan to their record.

A different sign out of monetary battle is multiple loan requests inside the good short space of time. Every time you create a formal application for the loan, your credit report is actually age times can enhance issues which have loan providers. It is for that reason that people highly recommend prepared 90 days out of your past software for borrowing from the bank prior to putting in your own official financial demand.

Dumps and private loans

We have been will asked if it is you’ll be able to discover an effective unsecured loan to finance the new put to own a house purchase. While the address actually a strict no’, the causes in depth significantly more than is show that this is simply not in https://availableloan.net/personal-loans-sc/ place of problems.

Regarding their deposit, the mortgage bank is looking feeling comfy you are into the a safe financial position consequently they are taking up some of the possibility of owning a home on your own. In initial deposit financed compliment of an unsecured loan doesn’t inform you men and women qualities, yet not, its a better suggestion towards the merchant than simply an excellent 100% LTV financial (no-deposit home loan).