Oklahoma Price and you can Name Re-finance Mortgage brokers enable it to be individuals to change their established financial with a new you to

The primary purpose of a speeds and you will identity refinance is to safe so much more beneficial financing criteria, such as for example a reduced interest that minimizes monthly obligations otherwise another type of loan identity that can either disappear repayments otherwise shorten the mortgage cycle, which could or may not trigger lower monthly costs. On top of that, a rate and term re-finance can be used to switch from that mortgage program to another, potentially reducing the need for home loan insurance policies.

Oklahoma Cash-out Mortgage loans

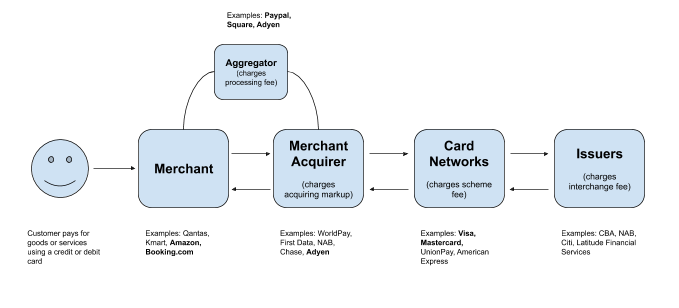

Oklahoma Cash-Out Re-finance $255 payday loans online same day North Dakota Mortgage brokers range from speed and you can term refinances from the allowing property owners to gain access to the new security inside their residential property. That have a profit-away re-finance, your alter your current financial with a new one to possess an effective highest amount than the established mortgage balance. The difference is offered to you within the dollars otherwise shall be familiar with combine obligations, to the finance reduced within closure. Cash-aside refinances typically have straight down mortgage-to-value rates than simply speed and you may title refinances and might have slightly higher interest levels.

Oklahoma Construction Mortgage loans

A-one-day romantic structure financing in the Oklahoma is a money option one to brings together the building and permanent financial phases into a single mortgage procedure. Read more