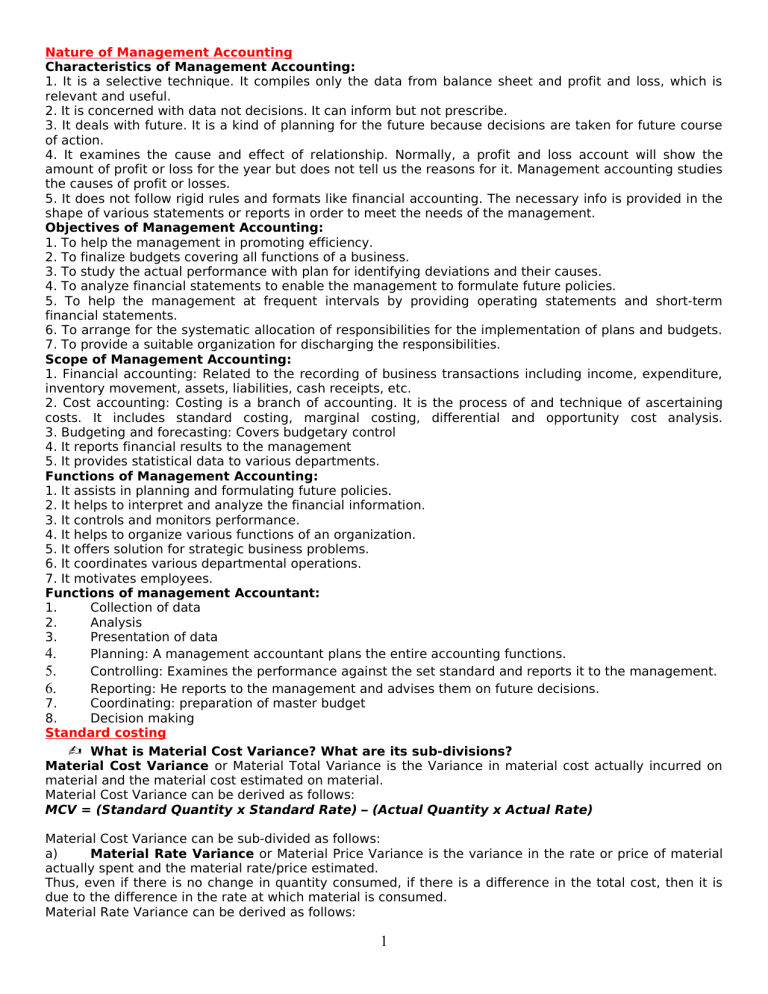

EA vs CPA: What’s the Difference Between These Tax Pros?

It’s really a personal choice what size company you want to work for, but you should consider benefits that can affect your quality of life. Offer some benefits (e.g., gyms, cafeterias, and daycare) that smaller firms can’t reasonably fit into their budgets. Considering becoming an Enrolled Agent, but curious about the salary prospects? Take a look at our Enrolled Agent Salary Guide to get an idea about industry salary range. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. If you have accounting needs with a micro focus, working with an EA could be the perfect fit for you.

- The most highly specialized Enrolled Agent probably isn’t going to be earning as much at a smaller organization as they could at a larger one.

- Enrolled agent salary is impacted by location, education, and experience.

- Staff accountants handle various financial duties such as ensuring financial statements are prepared correctly and that companies follow the laws and regulations for financial practices.

- While this position is commonly filled by a CPA, the Enrolled Agent designation is a great way to secure your tax specialization.

See what you can earn as an Enrolled Agent

The average enrolled agent salary has risen by $3,188 over the last ten years. In 2014, the average enrolled agent earned $31,983 annually, but today, they earn $35,171 a year. That works out to a 4% change in pay for enrolled agents over the last decade. CPAs typically do most of their work for public enrolled agent salary accounting firms of all sizes. They could be specifically licensed as auditors, financial planners, corporate and executive accountants and tax consultants. So CPAs could assist in all accounting, tax and financial services for the businesses, individuals and other organizations they may represent.

What is the Career Path of CPA Enrolled Agent?

On the other hand, if you are interested in accounting practices that have nothing to do with taxes, such as auditing, then the CPA option may be best. A financial advisor can help you maximize the tax efficiency of your investments and assist you in creating and carrying out a long-term plan. Offer more flexibility and greater access to management, giving individuals a greater say in the perks and fringe benefits available. Staff accountants handle various financial duties such as ensuring financial statements are prepared correctly and that companies follow the laws and regulations for financial practices. They handle balancing the budget and must use budgeting and auditing software programs. Our job description management tool- JobArchitect streamlines your job description process.

- Jobs paying $58,500 or less are in the 25th percentile range, while jobs paying more than $83,000 are in 75th percentile.

- This means EAs can represent any taxpayer, regardless of whether they prepared their income tax return.

- Each of the exam’s four sections costs about $200, depending on the state.

- A financial advisor can help you maximize the tax efficiency of your investments and assist you in creating and carrying out a long-term plan.

Tips for Managing Your Taxes

- In addition, the average enrolled agent salary at companies like Smoker Craft Boats and Independent Health are highly competitive.

- However, it is vastly cheaper than that of preparing and sitting for the EA exam, and takes much less time to complete.

- If you have accounting needs with a micro focus, working with an EA could be the perfect fit for you.

- A smaller step, but still one in the direction of earning more for your expertise, is completing the Annual Filing Season Program.

- Learn how becoming a tax expert can help you excel at firms of all sizes on our Enrolled Agents at the Big 4 blog.

- Whether you’re just getting started as an Enrolled Agent or are already a CPA wanting to specialize in tax, dual certification is the best way to help yourself stand out from the crowd.

Typical EA responsibilities include representing business or individual clients in tax audits, tax appeals and tax collections. Additionally, EAs can also provide tax advice, tax return filing and more. According to the 2024 Robert Half Salary Guide, hiring trends in accounting and finance continue to favor the job candidate. Firms are looking to fill entry-level positions, so recent accounting grads and young professionals are in a great position to get their first accounting job. Firms are especially interested in candidates with technology skills that can be applied to growing areas like cloud systems and data analysis.

- For example, daycare can be a considerable expense for young working families.

- Bookkeepers ensure that a business makes the most economically viable and safe decisions to keep finances tight and under control.

- Big cities have more job opportunities and a larger pool of skilled workers, but they also typically have a higher cost of living, so location isn’t everything.

- However, which one you should consult depends on which issue you want to resolve.

- What’s more, general population demand is greater for CPAs than EAs.

As of October 2021, the Bureau of Labor Statistics (BLS) recorded the national median salary for CPAs in the U.S. as $73,560. Jobs paying $58,500 or less are in the 25th percentile range, while jobs paying more than $83,000 are in 75th percentile. An enrolled agent, or EA, is a kind of tax professional who focuses narrowly on managing tax arrangements for business or private entities. EAs boast a wide range of knowledge in such tax-related subjects as income, estate, gift, payroll, levies, returns, inheritance, non-profit and retirement taxes. Enrolled agent salaries at IDEMIA and Acuity Insurance are the highest-paying according to our most recent salary estimates. In addition, the average enrolled agent salary at companies like Smoker Craft Boats and Independent Health are highly competitive.

There is also a continuing education component, but the exact number of credit hours varies by state. To become a CPA a person must take 150 hours of public accounting courses, typically done at a college or university. For example, daycare can be a considerable expense for young working families. On-site daycare could save thousands of dollars and dozens of hours in commuting each year. At the same time, some people dislike the bureaucracy that comes with larger organizations, and they’re happier at the end of the day if they have more freedom to pursue their own ideas.

Managers are looking for new ideas and are prepared to provide the necessary on-the-job training to prepare new hires for success. This is a great time to go into accounting, and becoming an Enrolled Agent will help you land an even bigger starting salary than you could without it. If you’re applying for your first tax preparation job, your experience includes your education and any relevant extracurricular activities you participated in (such as the IRS’s https://www.bookstime.com/articles/net-realizable-value VITA program). Once you get your first job, experience starts to include actual time working in the industry and your accomplishments at work. EAs could help you work through an IRS audit or a collection problem, and they can also perform bookkeeping services that could be useful for businesses when preparing tax returns. A smaller step, but still one in the direction of earning more for your expertise, is completing the Annual Filing Season Program.

Which companies pay enrolled agents the most?