Congress may also consider using an income-mainly based interest model to experience the difficulty of student loan financial obligation

Also these types of selection, the us government can also be lose notice capitalization-a practice by which one delinquent focus gets set in the fresh new dominating balance at particular incidents (such as for example deferments and you may forbearance)-and additionally negative amortization, a direct effect in which good borrower’s payment per month isnt sufficient to shelter each other attract and you will prominent. 39 Given that government has recently pulled extremely important actions because of a beneficial regulating suggestion to cease extremely notice-capitalizing situations, some of these occurrences is actually legal and will just be eliminated by Congress (for example leaving deferment and making income-dependent payment). Ergo, Congress need to eliminate the kept statutory appeal-capitalization situations. Including eliminating attention capitalization, the us government is always to reduce bad amortization, to ensure that any unpaid attract isnt put in the primary balance away from financing, long lasting package put along with acquisition so individuals cannot discover ballooning balances throughout the years. Organizations eg New The united states have likewise suggested which, and Congress must look into these proposals when reforming this new education loan program. 40 not, this too may likely carry a life threatening pricing.

Within the thinking about long-term monetary rescue to possess current and you will upcoming consumers, Congress should reform brand new education loan system by making a good revolving financing. Nowadays, most of the money one to consumers make with the one another focus and principal wade on Standard Financing. 41 This is basically the exact same the-mission fund the government spends to pay for a beneficial wide variety away from authorities applications. Congress you can expect to as an alternative do a rotating loans or an alternate money in which student loan money can help financing certain high studies software, including Pell Provides and other scholar credit card debt relief selection. 42 not, Congress may still need certainly to enhance that it money off time to go out in case it is useful credit card debt relief.

Forgive you our very own expenses: Improving Public service Loan Forgiveness and you can money-passionate fees

The fresh government education loan system has the benefit of essential cover, particularly money-motivated payment (IDR), in order that consumers are able to afford the monthly premiums and have now the debt forgiven after a period of energy. The new IDR bundle toward longest road to termination even offers forgiveness just after 25 years off money. Several other system, called Public-service Mortgage Forgiveness (PSLF), was designed to create public sector works reasonable to those having education loan loans, providing forgiveness once ten years.

But on account of administrative disappointments, not many individuals features knew the many benefits of loans forgiveness significantly less than such programs. 43 Even though Congress tried to boost the brand new PSLF system by making the new Short term Stretched Public-service Mortgage Forgiveness (TEPSLF) system, it augment was alone full having difficulties, and a confusing software procedure. 49 In response to those management problems, the fresh Biden administration has had important strategies as a consequence of waivers one temporarily convenience certain qualification laws and regulations to pay to possess flaws regarding the software and you may errors from mortgage servicers and you will early in the day administrations. not, these waivers was temporary in the wild, and they’ll most likely end nearby the avoid of your own federal crisis stated responding with the pandemic. Brand new Company regarding Education has just suggested the newest regulating changes so you’re able to PSLF who would allow more relaxing for borrowers having the costs number with the forgiveness. The changes would make improvements to the application techniques; explain definitions; and invite particular periods from forbearance, deferment, and you will payments made in advance of involvement for the good PSLF-secure want to matter to your forgiveness. forty five These regulations are certain to get a significant impact on consumers. not, just like the detailed on the explanatory areas of the fresh new proposed laws, there clearly was still so much more to achieve that can’t be accomplished courtesy rules by yourself.

Considering the long-standing complications with IDR and you can PSLF, 46 the brand new management is to extend brand new PSLF waiver past their newest expiration off , and you may Congress will be codify components of current IDR, PSLF, and other COVID-19-related waivers to your rules to make the repairs long lasting and make certain that more individuals qualify having save. 47 Additionally, just like the administration’s advised PSLF change doesn’t begin working up to , it will be essential brand new government to increase the newest PSLF waiver through to the the fresh laws begin working, stopping a space from inside the visibility. Congress may fit this new administration’s proposed PSLF regulating transform by and work out change that allow gurus whom give personal qualities during the to own-cash entities so you can qualify for PSLF and also by which have states and you can municipalities donate to deciding which professions let see local and regional need which means be eligible for PSLF.

Because the government pursues which bold and you can necessary action to the pupil debt termination, it should secure the adopting the trick one thing at heart:

Preventing this example subsequently

Pulled together, after that investment inside Pell, FSEOG, and you will FWS will assist a lot more college students financing the amount and defense their bills without the need to sign up for finance. This will suggest quicker financial obligation having current and you may coming children and you can create a good for the highest education’s pledge from monetary chance and you can flexibility.

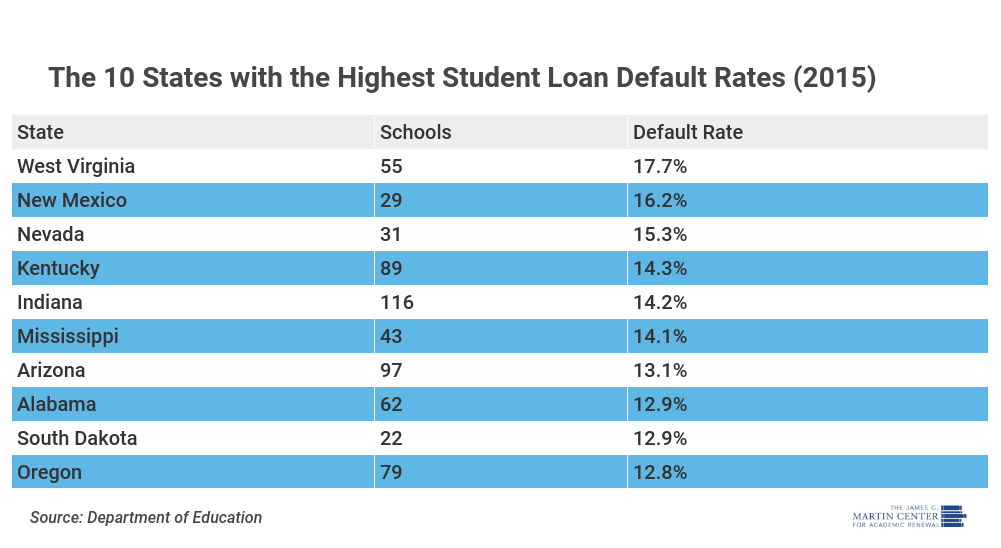

Particularly, considering the fee pause toward student loans through the this new COVID-19 pandemic, students haven’t needed to generate payments on the financing, effortlessly reducing the possibility of default. Although this is yes a very important thing for students and you can borrowers, while the Heart getting American Advances possess in the past listed, it’ll have an impact on CDR data in the years ahead. twenty six This means that for a time, CDR are not a helpful size having holding establishments guilty to own poor consequences. In line with previous Cap advice, Congress is to incorporate cost prices and standard pricing due to the fact a liability method. 27

Along with read

For the majority of commercial loans, an effective borrower’s interest rate is dependent on their credit rating or its monetary power to pay-off a loan. More the fresh new monetary stability, the low the rate. not, lower than a full time income-dependent attract means, attention on figuratively speaking wouldn’t begin to accrue up until an excellent debtor you may manage to spend one to notice-like, once they arrive at a-flat money endurance particularly $one hundred,100 or more. This may not be a giant plunge for the student loan system, because authorities currently will pay the eye into subsidized loans when you are a borrower is within college, during sophistication episodes, and throughout the deferments. This means that payday loan Pemberwick individuals demonstrating economic you need commonly needed to pay attract to their funds up to after they exit college or have effective payment. An income-established attention design would simply continue that time where an excellent borrower with financial you would like wouldn’t be needed to pay attract to their finance. Which rules is actually maintaining brand new intention of the government financial aid applications, which provide help so you’re able to youngsters predicated on need.